Tax brackets in Malaysia. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking.

Getting To Know Gilti A Guide For American Expat Entrepreneurs

Malaysia has the following income tax brackets based on.

. Under the TCJA AMT exemptions phase out at 25 cents per dollar earned once taxpayer AMTI hits a certain threshold. The new rates are 10 12 22 24 32 35 and 37. Financial years 201819 201920.

Discover Helpful Information And Resources On Taxes From AARP. On the First 5000 Next 15000. In 2018 the 28 percent AMT rate applies to excess AMTI of 191500 for all married taxpayers 95750 for unmarried individuals.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. Ad Browse discover thousands of brands. YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900 24 400000 83650 25 600000 133650 26.

The Tax tables below include the tax rates thresholds and allowances included in the Malaysia Tax Calculator 2019. The criteria to qualify for this tax exemption are. Taxable income Tax on this income Effective tax rate 0 18200 Nil 0 18201 37000 19c for each 1 over 18200.

The standard deduction amount is increased from 6350 to 12000 for Single and Married Filing Separately filers 12700 to 24000 for Married Filing. On the First 5000. The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers.

The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020. Malaysian professionals returning from abroad to work in Malaysia would be taxed at a rate of 15 for the first five consecutive years following the professionals return to Malaysia under the Returning Expert Programme REP.

Many taxpayers will be in a lower tax bracket when they file their 2018 tax return. The following rates are applicable to resident individual taxpayers for YA 2021 and 2022. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with.

They will phase out in eight years. This income tax calculator can help estimate your average income tax rate and your salary after tax. Doubles the Standard Deduction.

However the marriage penalty could still burn high-income couples. Free easy returns on millions of items. As an initiative to increase home-ownership for the nation the Prime Minister in the Budget 2018 has allocated RM22 billion to the housing development in Malaysia.

Not only are the rates 2 lower for those who has a chargeable income between RM20000 and RM70000 the maximum tax rate for each income tier is also lower. Your 2021 Tax Bracket To See Whats Been Adjusted. Ad Compare Your 2022 Tax Bracket vs.

What is the income tax rate in Malaysia. Free shipping on qualified orders. What comes as a surprise to many is the 50 tax exemption on rental income received by Malaysian resident individuals.

Read customer reviews find best sellers. You and your spouse have taxable income of 110000. Income Tax in Malaysia in 2019.

Thats where you start to pocket cash when you find a new or additional tax deduction. Personal income tax rates. If you can find 10000 in new deductions you pocket 2500.

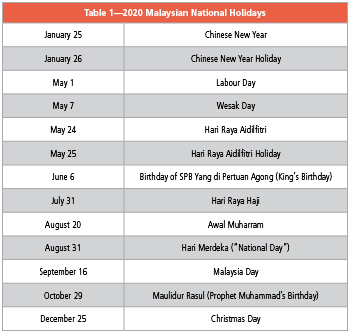

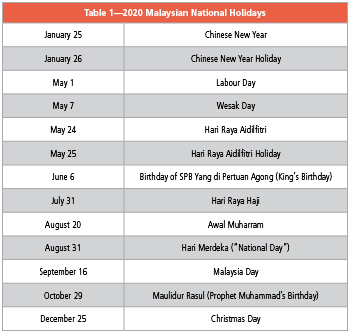

That puts the two of you in the 25 percent federal income tax bracket. 20182019 Malaysian Tax Booklet 14 Offences penalties. Changes the Seven Tax Rates.

20182019 Malaysian Tax Booklet Income Tax. Calculations RM Rate TaxRM A. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking.

Tax Reform Changes for Tax Years 2018. 12 rows For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups. Malaysia Personal Income Tax Rate A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020.

Is Corporation Tax Good Or Bad For Growth World Economic Forum

Skladnoj Skladnoj Por Rybalka Stul Dlya Piknika Barbekyu Sad Stul Stul Portativnyj Otdyh Na Prirode Instrumen Outdoor Folding Chairs Fishing Chair Outdoor Chairs

Alton Tax Rate Drops Nearly 11 Percent Local News Laconiadailysun Com

Malaysia Payroll And Tax Activpayroll

Estimating International Tax Evasion By Individuals

What You Need To Know About Payroll In Malaysia

Malaysian Tax Issues For Expats Activpayroll

Bafang Bbs01b Bbs02b Bbshd 250w 1000w E Bike Conversion Kit

Estimating International Tax Evasion By Individuals

Eximius Is The Bookkeeping And Accounting Outsourcing Specialist Aiming At Supporting Your Busines Bookkeeping Bookkeeping And Accounting Cloud Accounting

What Is A Homestead Exemption Protecting The Value Of Your Home

Annuity Taxation How Various Annuities Are Taxed

Date Sheet For Bg 2nd Semester Examination

If You Have Your Own Law Office Or Work As An Office Manager For One You Know That Your Office Organizat Law Office Office Organization At Work Office Manager

Malaysia Direct Tax Revenue Statista

Poland Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)